Why Bitcoin At $100K Is Just A “Matter Of Time”: Bloomberg Intelligence

[ad_1]

Bitcoin follows what Senior Commodity Strategist for Bloomberg Intelligence, Mike McGlone, calls an “enduring trajectory”. The benchmark crypto is one of the best-performing assets in history, as the expert said in a recent report, and might be on track to record fresh gains in the second half of 2022.

At the time of writing, BTC’s price trades at $23,900 with a 3% profit over today’s trading session and a 2.4% profit over the past week. The cryptocurrency seems to be trending upwards on the back of a decrease in inflationary expectations for July’s Consumer Price Index (CPI) print.

This metric has been recording multi-decade highs forcing the U.S. Federal Reserve (Fed) to take measures by decreasing its balance sheet and hiking interest rates. Thus, creating a hostile economic environment for risk-on assets, such as Bitcoin and equities.

The cryptocurrency might benefit from deflationary forces, McGlone believes. Bloomberg’s Commodities Index, and the price of key commodities, such as Oil and Copper, are hinting at this trend.

In that sense, the experts expect assets with fixed supplies to rally. This could set Gold and Bitcoin to hit $2,000 and $100,000, respectively, in the long term.

McGlone believes that the benchmark crypto is becoming a more stable, and less risky asset. This could translate into BTC operating as a “high-beta version of the metal (Gold) and Treasury bonds”.

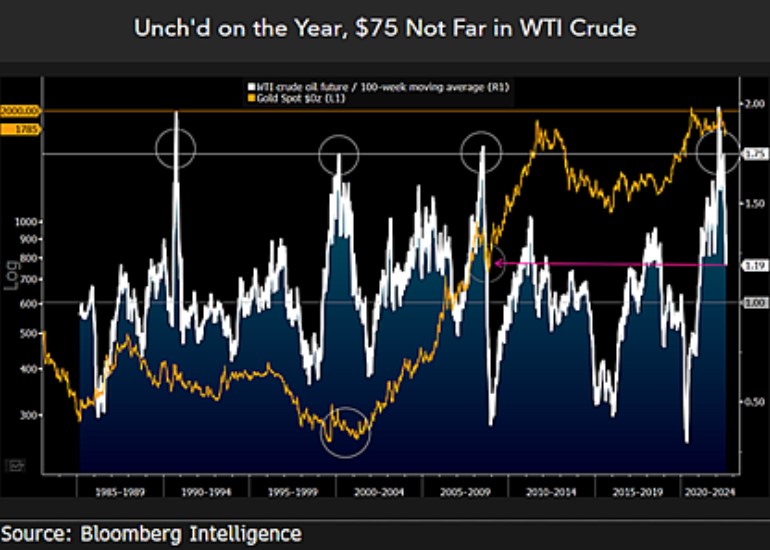

The price of Bitcoin and Gold might start “accelerating”, the report says, if the West Texas Intermediate (WTI) oil, a benchmark for oil pricing, follows the downside trend in commodities. McGlone wrote:

It’s a question of supply, demand and adoption in the next 14 years that should drive prices, and we see little reason to complicate what appear to be enduring trajectories, notable in advancing technology (…).

The Other Side Of The Coin, Why Bitcoin Could Sustain Its Gains

As seen below, the price of WTI oil broke above an important resistance level in 2021. McGlone noted that the price of Gold and oil have been historically inversely correlated.

Thus, why he seems convinced that oil is hinting at appreciation for the precious metal and its 2.0 version, Bitcoin. The Bloomberg Intelligence expert said:

Our bias is tilted toward more of the same pendulum (Oil down with Gold rising) swinging tendency for oil to continue downward in 2H. To the extent that sinking copper portend global deflationary trends and the potential for an end of Fed rate hikes, gold should gain underpinning to breach $2,000 an ounce.

[ad_2]

Source link